Bitcoin (BTC) reached a 40-day high on July 22, hitting $68,518. The 19.4% increase over the past 10 days has been driven by investor confidence in the U.S. Federal Reserve’s rate cuts in 2024, the end of Bitcoin sales by the German government, and a more positive regulatory outlook, especially in the U.S.

This surge has led to the Bitcoin futures premium, a key indicator of professional traders’ sentiment, reaching its highest level in five weeks. Investors are now wondering whether this scenario supports a rally to $72,000 despite uncertainties from the U.S. presidential election and global socio-political conditions.

Biden’s Decision Impact on Bitcoin Price

President Biden’s decision on July 21 not to run for re-election has increased the likelihood of former President Donald Trump and pro-crypto Vice President JD Vance winning the upcoming election. Vance has previously disclosed owning up to $250,000 in Bitcoin and voted in favor of a joint resolution to reverse the classification of cryptocurrencies as a liability on bank balance sheets.

Regardless of how crypto-friendly Trump’s potential cabinet might be in 2025, investors are also aware of the independence of the U.S. Federal Reserve (Fed) and the U.S. Securities and Exchange Commission (SEC). Fed Chairman Jerome Powell’s second term is expected to end in May 2026, while current SEC Chairman Gary Gensler has a five-year term ending in April 2026.

While investors are confident that the Fed will keep interest rates at 5.25% on July 31, there has been a significant shift in year-end expectations. According to the CME FedWatch tool, which uses the pricing model of U.S. Treasury yields, the market now estimates a 47% chance of two rate cuts at the December 18 meeting, up from 20.5% a month ago.

China, the world’s second-largest economy, is also facing uncertainties as investors are disappointed with the regime’s lack of short-term economic stimulus measures, according to Bloomberg. The People’s Bank of China cut the seven-day reverse repo rate for the first time in twelve months on July 22, from 1.8% to 1.7%. Morgan Stanley economists consider this move a “reactive” and “risky” response to their growth estimates for the region.

BTCFutures Suggest $72,000 Within Reach

To understand how these scenarios affect Bitcoin investors’ risk appetite, we need to analyze the BTC monthly futures premium. Prices on these contracts usually differ significantly from regular Bitcoin exchanges, unlike perpetual futures (inverse swaps). Typically, a 5% to 10% premium is expected to compensate for the longer settlement time.

The Bitcoin futures premium rose to 13% on July 22, marking a five-week high. Although lower than the 16% seen on June 7, the current premium indicates cautious optimism. This is crucial to avoid mass liquidations if sudden negative price swings occur.

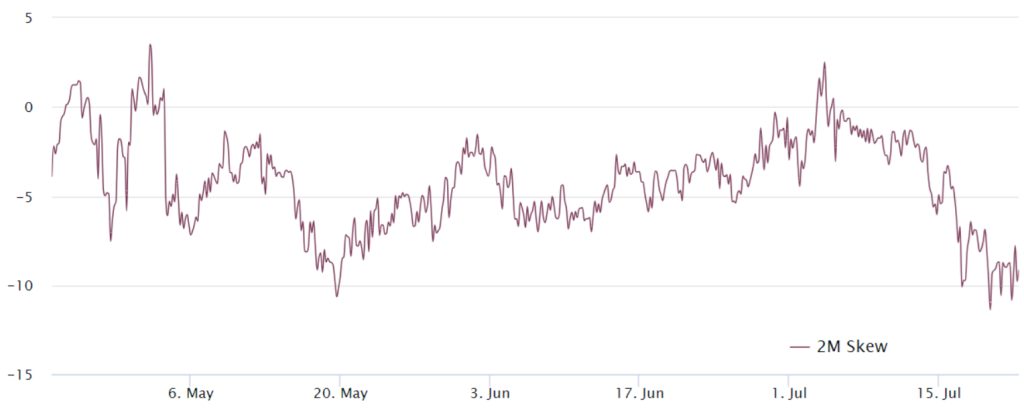

To determine whether this sentiment is only present in the futures market, it’s necessary to analyze the 25% delta skew of Bitcoin options, which measures the relative demand for call (buy) and put (sell) options. A negative skew indicates higher demand for call options, and the market is usually neutral when the delta skew ranges from -7% to +7%, indicating balanced pricing between these instruments.

The 25% delta skew for Bitcoin has remained stable near -9% since July 19, indicating traders are slightly optimistic about short-term price movements. The last time Bitcoin options showed similar confidence was on May 20, but this didn’t last as the price struggled to break the $71,500 resistance level.

The latest data indicates a healthy Bitcoin bull market, poised to retest the $72,000 level. Demand is driven by a mix of factors, including geopolitical uncertainty, confidence in central bank easing policies, and a more positive regulatory outlook for cryptocurrencies following the SEC’s dismissal of lawsuits and major investigations.

Besides the information above, there’s a promising project being promoted that the audience should not miss. Safari – a leading presale project on the BNB Smart Chain network, is being launched into the market and promises growth potential in the coming quarters.

For more information and to stay updated with the latest news and developments, join our vibrant community:

Website — https://safari.ong/

Telegram — https://t.me/Safarifinance_Group

Twitter ( X ) __ https://x.com/UkSafariFinance

Youtube __ https://www.youtube.com/@SafariFinance