Bitcoin experienced a sharp decline on Sunday after U.S. President Joe Biden announced he would withdraw from the presidential race. This drop led to $159 million in liquidations.

However, this pain didn’t last long. Bitcoin’s price has now recovered beyond its pre-drop level and surpassed $68,000 this morning.

At the time of writing, Bitcoin has dipped to $67,084 – but it is still trading 0.5% higher than this time yesterday. Furthermore, BTC has risen 7.1% over the week and has seen a trading volume of $30 billion in the past 24 hours.

While Biden’s withdrawal from the 2024 presidential election is undoubtedly a significant catalyst for some investors, other macroeconomic factors are also at play.

The People’s Bank of China (PBOC) surprised the market by unexpectedly cutting short-term policy rates and the benchmark lending rate on Monday – a major move from the world’s second-largest economy.

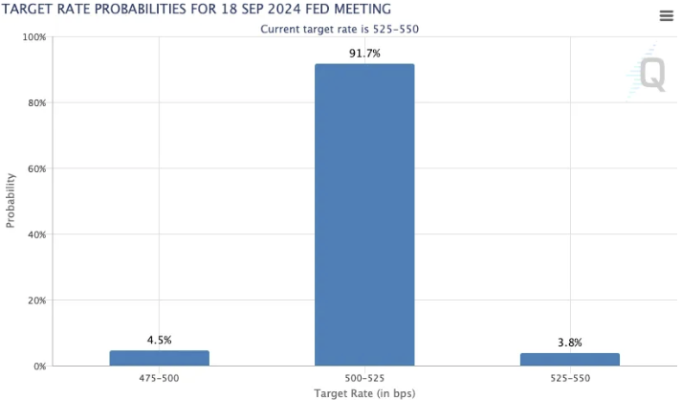

This announcement comes as investors look ahead to the next meeting of the Federal Reserve’s Federal Open Market Committee (FOMC), scheduled for July 31.

According to CME, currently, about 95% of investors are confident that the FOMC will hold rates steady in nine days, while 92% expect the FOMC to cut rates after the September 18 meeting.

Bitcoin tends to rally if the Fed cuts rates because it makes investments like treasury bonds less attractive. This generally leads traders to allocate a larger portion of their assets into riskier categories, such as stocks and cryptocurrencies.

Currently, traders are eagerly awaiting new economic data from the Bureau of Economic Analysis, set to be released this week, to reinforce their positions before September.

Another factor to watch: The commencement of spot Ethereum ETF trading in the U.S., expected on Tuesday, July 23. While this will be a significant launch for spot Ethereum ETFs, it could also bolster Bitcoin’s positive momentum and push it to its highest level in a month.

“If this trend continues, Bitcoin could surpass $70,000 tomorrow with the launch of the Ethereum ETF. Although the likelihood of Bitcoin accelerating parabolically seems low at this point, positive ETF inflows could sustain the bullish momentum longer than expected,” wrote BRN analyst Valentin Fournier.

For more information and to stay updated with the latest news and developments, join our vibrant community:

Website — https://safari.ong/

Telegram — https://t.me/Safarifinance_Group

Twitter ( X ) __ https://x.com/UkSafariFinance

Youtube __ https://www.youtube.com/@SafariFinance