“Bitcoin (BTC) is undergoing ‘short-term selling pressure decline’ as it approaches $65,000, according to on-chain data from Glassnode.

Data from TradingView shows Bitcoin has risen over 20% from a low of $56,616 on July 12 to a daily high of $65,210 on July 16, attributed by Glassnode to ‘a complete exhaustion of selling pressure from the German government.’

According to on-chain analysis platforms, large entities including miners and institutions have historically been the primary sellers. The recent drop in Bitcoin’s price to around $53,000 is largely attributed to anticipated reimbursements from the Japanese-based cryptocurrency exchange Mt.Gox and the sale of BTC by the German government.

‘Focusing more on the selling pressure from the German government, we can see their balance of 48.8 thousand BTC depleted within just a few weeks. The majority was distributed in a very short period from July 7 to July 10, with over 39.8 thousand BTC flowing out of labeled wallets.'”

This translation captures the main points from the provided text.

“Glassnode’s report notes that the majority of Germany’s government sales occurred after Bitcoin’s price dropped to around $54,000 and did not decline further. This indicates the market had priced in these sales.

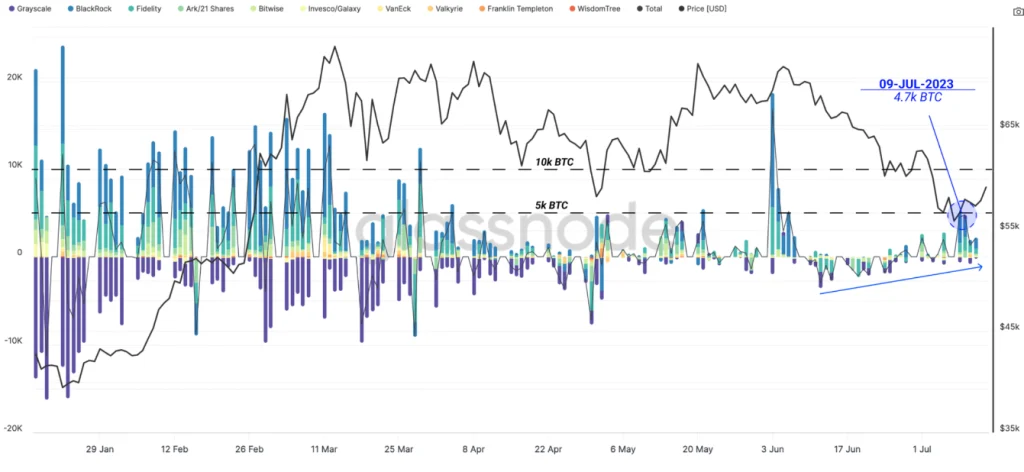

According to Glassnode, a period of continuous inflows across all ETFs in recent days has helped alleviate selling pressure in the Bitcoin market.

The sell-off to $54,000 pushed BTC below the average cost basis inflow of ETF holders, currently at $58,200, coinciding with the 200-day moving average. The report highlights that ‘ETFs have witnessed significant positive interest for the first time since early June, with over $1 billion inflows in total just in the past week.'”

This translation captures the main points from the provided text.

“This is confirmed by data from CoinShares, which shows Bitcoin investment products saw the fifth consecutive weekly inflow record, totaling $1.347 billion from July 8 to July 12.

Similarly, data from SoSo Value reveals that Bitcoin spot ETFs have witnessed seven consecutive days of net inflows, with over $300 million flowing into 11 ETFs in the US on July 15.”

This translation captures the information about the inflows into Bitcoin investment products as reported by CoinShares and SoSo Value.

For more information and to stay updated with the latest news and developments, join our vibrant community:

Website — https://safari.ong/

Telegram — https://t.me/Safarifinance_Group

Twitter ( X ) __ https://x.com/UkSafariFinance

Youtube __ https://www.youtube.com/@SafariFinance