Bitcoin (BTC) continued to trade lower during the Asian session on July 30 after facing a swift rejection at resistance, causing a $4,000 price drop for BTC.

BTC Price Fails to Hold Crucial Support

Data from TradingView showed the BTC/USD pair trading around $66,500, repeating the daily opening price.

The previous day saw volatility throughout, with Bitcoin initially pushing up to $70,000 but unable to hold — a familiar scenario — instead falling nearly 6% within a few hours.

As reported by Bitcoin Magazine this morning, this move coincided with $2 billion worth of BTC leaving a wallet linked to the US government.

This transaction contrasted with the commitment to use the funds to build a strategic Bitcoin reserve announced by presidential candidates Donald Trump and Kennedy Jr. over the weekend at the Bitcoin 2024 Conference.

William Clemente, co-founder of crypto research firm Reflexivity, described the timing as “not coincidental.”

“A bit of short-term washout and summer range, then maybe just up,” he predicted about the BTC price action moving forward.

Keith Alan, co-founder of trading resource Material Indicators, hoped that bullish traders could recover to defend the ascending trendline on the daily timeframe.

In further comments on X, he argued that higher levels than seen this week, specifically $72,000 and above, depend on bullish traders first flipping the 2021 all-time high of $69,000 into solid support.

“That is the higher level that bulls need to surpass before BTC is positioned to aim for an all-time high (ATH), and I think that will eventually happen, but I still believe we won’t see a sustainable move to a new ATH until we confirm and flip $69k,” he wrote.

Meanwhile, popular trader Roman focused on short-term BTC price targets, falling to $60,000.

If the market drops to that level, he predicted, sentiment would force a short squeeze allowing the BTC/USD pair to return to the upper part of the long-term trading range.

“Watching price targets of 64 and 60k respectively. Displaying bearish divergence with a potential double-top reversal setup,” he confirmed.

My bet is sentiment will get extremely negative at these levels then we pump again.

“After hitting $70K yesterday, Bitcoin sold back into the range I was watching yesterday,” trader Mark Cullen continued in his analysis on X.

“The question now is whether the trendline and golden pocket hold and create a higher low (HL) or BTC will bounce to a lower high (LH) and return to the lower range I was targeting?”

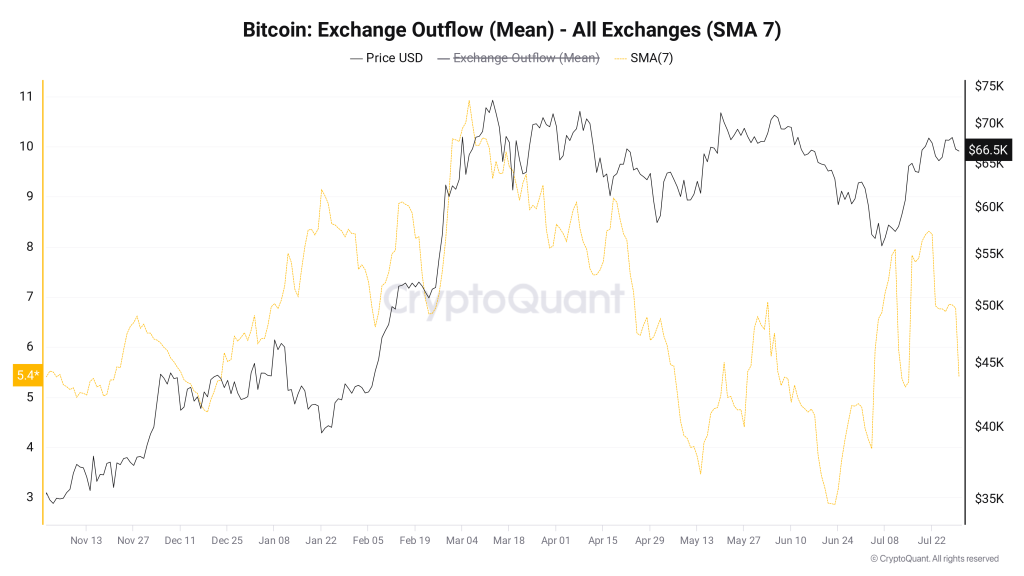

Bitcoin Traders Increase Exchange Withdrawals

In some of its latest analysis, on-chain analytics platform CryptoQuant noted what it called “increased” withdrawals from exchanges.

CryptoOnchain, a CryptoQuant analyst, observed that the average amount of BTC per exchange withdrawal transaction is rising.

“This happens despite Bitcoin entering a range-bound area since February,” they wrote in accompanying comments.

“The increase in the amount of BTC being withdrawn could be a positive sign of a potential price increase and a future breakout from the range-bound area.”

See the BTC price live here.

Disclaimer: This article is for informational purposes only and not investment advice. Investors should conduct thorough research before making any decisions. We are not responsible for your investment decisions.