In the tense political climate in the U.S., financial analyst Michael A. Gayed recently noted that national debt exceeding $35 trillion poses a greater threat to democracy than political leadership. Gayed emphasized that the debt’s growth rate surpasses both tax revenues and inflation, creating a precarious financial environment.

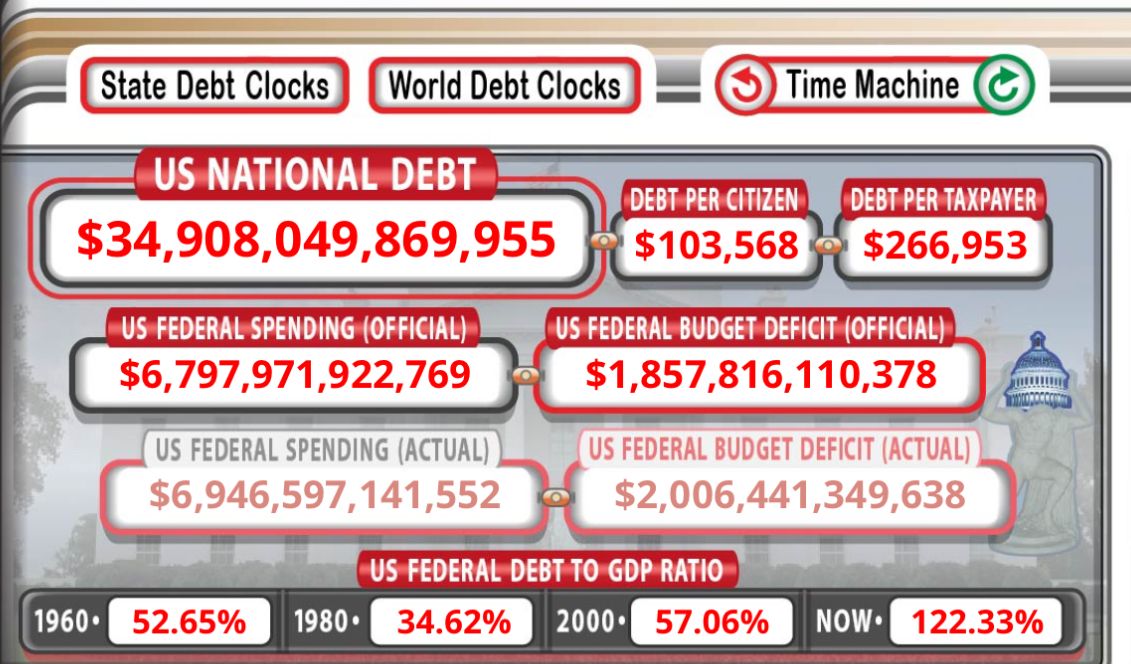

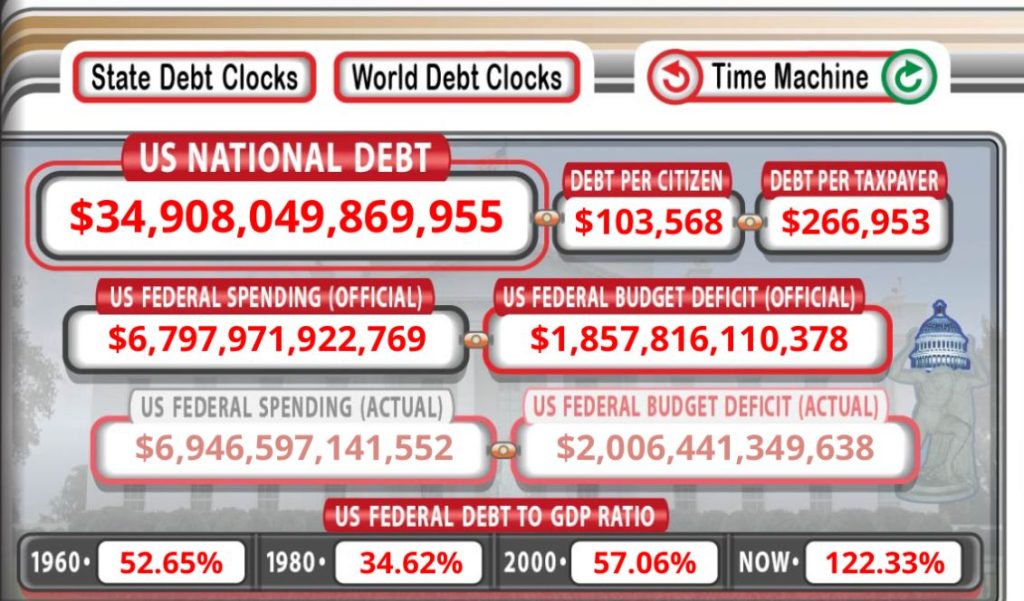

The U.S. federal debt-to-GDP ratio has risen from 52.65% in 1960 to 122.33% today, illustrating the sustainability issues of the country’s financial policies. The risk of a severe economic recession is increasingly apparent as debt continues to grow uncontrollably.

The U.S. national debt now stands at $34.9 trillion. Debt per citizen is $103,568, while debt per taxpayer has risen to $266,953. The U.S. federal budget deficit is also significant, with the official figure at $1.8 trillion and the actual deficit exceeding $2 trillion.

Voorhees also believes that the current political landscape, represented by leaders like Trump and Biden, cannot alleviate this situation. An annual debt increase of over $1 trillion in any reasonable scenario indicates a concerning financial outlook. Voorhees sees this unsustainable debt growth as a greater threat to democracy than any political figure.

The consequences of such an economic collapse are profound. Voorhees envisions a scenario where society can navigate through this turmoil with dignity and principles, potentially becoming more prosperous. However, this will differ significantly from the concept of large nations in the 20th century. He believes that Bitcoin or similar decentralized assets are key to this transformation. Through its intrinsic economic game theory, Bitcoin can prevent monetary degradation that allows large nations to expand.

Bitcoin’s status as a more sustainable asset compared to fiat currencies, which is not yet fully recognized, could be crucial in this transition. Voorhees believes that as Bitcoin is seen as a more stable store of value across generations, it can limit the expansion of large nations by curbing their ability to inflate their currencies.

If the Republicans win in November, Voorhees believes Trump and Vance are unlikely to significantly reduce the debt but could create an environment where cryptocurrencies can thrive. By doing so, they will allow the roots of cryptocurrency to deepen in culture and economics, potentially strong enough to withstand anticipated financial volatility.

“The best thing Trump/Vance can do during their term, since they cannot (and will not) significantly reduce the debt situation, is to create four years of space allowing cryptocurrency to grow, unimpeded.”

Voorhees’ perspective reflects a broader sentiment in the cryptocurrency community, viewing decentralized digital assets as a potential safeguard against the economic instability of massive national debts. The cryptocurrency industry’s ability to provide an alternative to traditional monetary systems could be crucial in addressing future financial challenges.

For more information and to stay updated with the latest news and developments, join our vibrant community:

Website — https://safari.ong/

Telegram — https://t.me/Safarifinance_Group

Twitter ( X ) __ https://x.com/UkSafariFinance

Youtube __ https://www.youtube.com/@SafariFinance