The US Securities and Exchange Commission (SEC) has approved two spot Ethereum exchange-traded funds (ETFs) — Grayscale Ethereum Mini Trust and ProShares Ethereum ETF — for listing on the NYSE Arca electronic trading platform, according to a July 17 filing.

The approval of the Form 19b-4 filing allows NYSE to facilitate the trading of these funds. However, the issuers still need to await final comments on the S-1 filings of the ETFs before these products can be officially listed.

‘Grayscale is pleased to announce that the SEC has approved the 19b-4 filing for the Grayscale Ethereum Mini Trust (proposed ticker: ETH). Grayscale continues to work constructively with SEC staff as we seek full regulatory approval for our Ethereum ETP products in the US,’ a Grayscale spokesperson said in a statement.

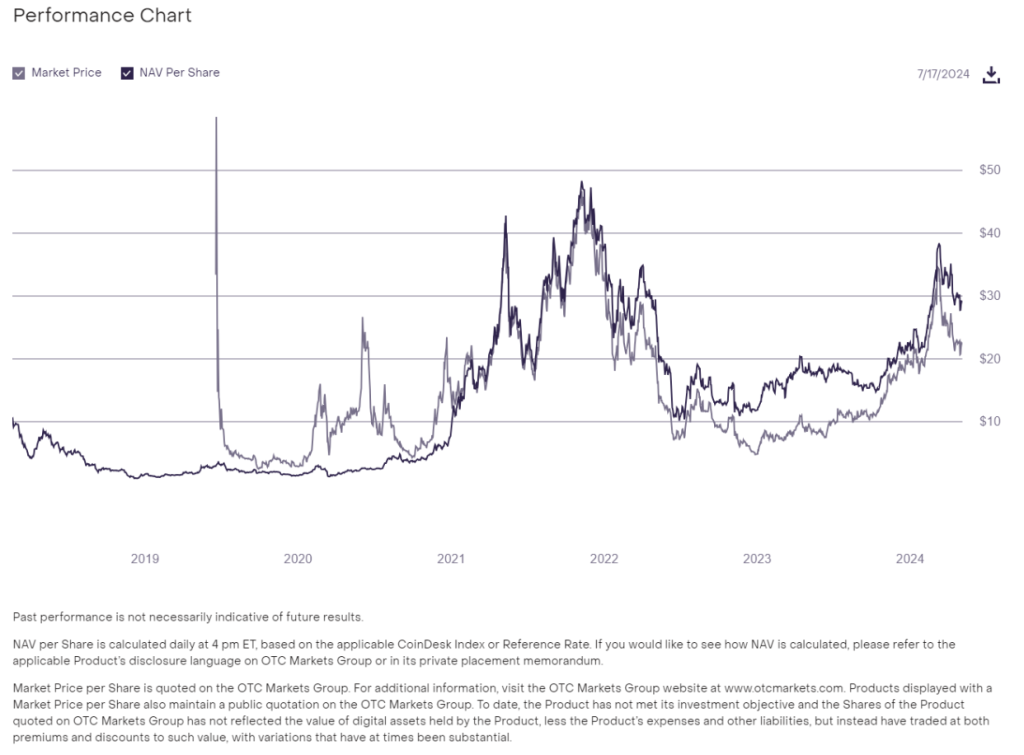

The Grayscale Ethereum Mini Trust is one of two Ethereum-based ETFs that the cryptocurrency investment manager is preparing to list. In May, Grayscale received SEC approval after filing Form 19b-4 to convert its previous spot ETH fund, Grayscale Ethereum Trust (ETHE), into an exchange-traded fund.

On July 17, Grayscale announced plans to distribute shares of the new Mini Trust to holders of the ETHE fund. The Grayscale Ethereum Trust was initially launched in 2017 and was one of the first institutional investment vehicles for Ethereum.

US SEC Approves Ethereum ETFs by Grayscale and ProShares for Trading on NYSE Arca

According to reports, the SEC has tentatively approved at least three issuers to start trading Ethereum-based ETFs as early as July 23. A total of eight Ethereum-based ETFs are awaiting final approval from the regulator after several weeks of back-and-forth dialogue with the SEC and numerous amendments to the funds’ S-1 filings.

ProShares Ethereum ETF entered the race later than its competitors, filing Form 19b-4 approximately three weeks after the other funds were approved. The ProShares fund is not among the eight ETFs expected to list next week.”

This translation maintains the detailed information regarding the SEC’s approval of the Ethereum ETFs by Grayscale and ProShares for trading on the NYSE Arca.

Besides the capital flow of Bitcoin, the BNB Smart Chain network coin project is something investors cannot overlook.

SAFARI FINANCE – the forefront of innovation and breakthroughs in the dynamic field of finance and cryptocurrency.

SAFARI FINANCE is a pioneering technology company based in the United Kingdom, committed to unlocking transformative innovation and breakthroughs in the financial and cryptocurrency sectors. Our journey began with a dream – a vision of creating a decentralized, secure, and user-friendly financial world accessible to everyone.

For more information and to stay updated with the latest news and developments, join our vibrant community:

Website — https://safari.ong/

Telegram — https://t.me/Safarifinance_Group

Twitter ( X ) __ https://x.com/UkSafariFinance

Youtube __ https://www.youtube.com/@SafariFinance